Dave Ramsey Zero-Based Budget⁚ A Comprehensive Guide

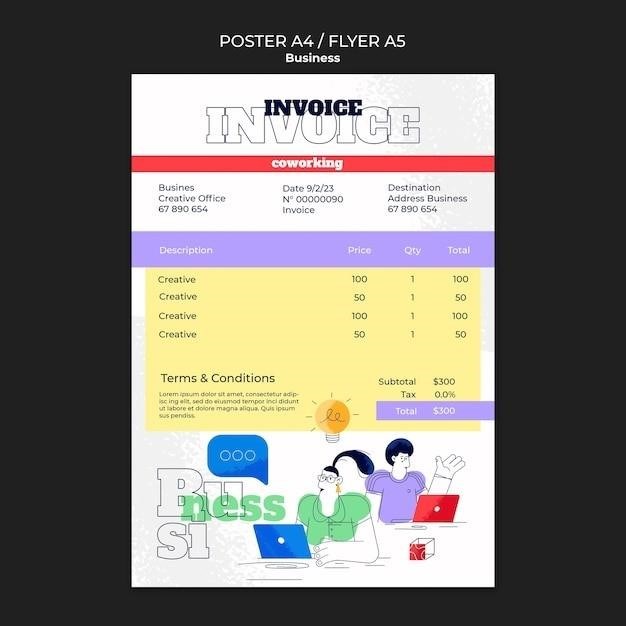

This is a zero-based budget form available for instant download after purchase! I’ve had requests for this form several times over the years as it WORKS! Track your income and expenses and allocate every dollar to a specific category.

Introduction

In the realm of personal finance, Dave Ramsey’s Zero-Based Budgeting method stands as a powerful tool for achieving financial freedom. This comprehensive approach emphasizes meticulous planning and allocation of every dollar, ensuring that your money is working for you, not against you. The “zero-based” principle stems from the idea that every dollar of your income should be assigned a specific purpose, whether it’s covering essential expenses, paying off debt, or building your savings. This method empowers you to take control of your finances, eliminate wasteful spending, and achieve your financial goals with greater clarity and purpose.

What is a Zero-Based Budget?

A zero-based budget is a budgeting method that involves allocating every dollar of your income to a specific purpose. Unlike traditional budgeting, which often relies on carrying over unused funds from the previous month, a zero-based budget starts from scratch each month. This means that you must consciously decide where every dollar will go, leaving no room for unplanned spending or overspending. The goal is to ensure that your income minus your expenses equals zero, hence the name “zero-based.” This meticulous approach forces you to prioritize your spending and ensure that your money is working in alignment with your financial goals.

Dave Ramsey’s Zero-Based Budgeting Method

Dave Ramsey, a well-known financial expert, advocates for a zero-based budgeting approach as a key element of his “Total Money Makeover” program. His method emphasizes a disciplined and proactive approach to managing your finances. Ramsey’s philosophy centers on the idea that every dollar should have a designated purpose, whether it’s for essential expenses, debt repayment, savings goals, or even fun money. This eliminates the ambiguity of “leftover” funds and encourages you to actively allocate your money to achieve your financial objectives. Ramsey’s zero-based budgeting method, therefore, empowers you to take control of your finances, prioritize spending, and build a solid foundation for a brighter financial future.

The Core Principle

The core principle of Dave Ramsey’s zero-based budgeting method is simple yet powerful⁚ allocate every dollar of your income to a specific purpose. This means that every dollar is accounted for, leaving no room for unplanned spending or financial surprises. The principle is based on the idea that you don’t simply track your expenses and then subtract them from your income. Instead, you start with your income and allocate it to all your expenses, debt payments, and savings goals. This approach fosters a sense of responsibility and accountability, forcing you to make conscious decisions about how you spend your money. By allocating every dollar, you create a clear picture of where your money is going and how it aligns with your financial goals. This allows you to make informed decisions about your spending, prioritize your needs, and effectively manage your financial resources.

Benefits of Zero-Based Budgeting

Dave Ramsey’s zero-based budgeting method offers numerous benefits, empowering you to take control of your finances and achieve your financial goals. By allocating every dollar, you gain a clear understanding of your spending habits and identify areas where you can cut back. This conscious approach helps you eliminate unnecessary expenses and redirect those funds towards savings, debt repayment, or other priorities. Furthermore, zero-based budgeting promotes financial discipline and accountability. You become more mindful of your spending choices and develop a proactive approach to managing your money. This disciplined approach can lead to a significant reduction in debt, as you prioritize debt repayment and allocate funds accordingly. Additionally, zero-based budgeting allows you to prioritize your financial goals and allocate funds accordingly. Whether you dream of a comfortable retirement, a down payment on a house, or simply building an emergency fund, zero-based budgeting provides a structured framework to achieve those aspirations.

How to Create a Dave Ramsey Zero-Based Budget

Creating a Dave Ramsey zero-based budget is a straightforward process that requires careful planning and commitment. Start by gathering all your financial documents, including bank statements, credit card statements, and any other relevant information. Once you have a clear picture of your income and expenses, you can begin the budgeting process. Dave Ramsey emphasizes the importance of tracking your income and expenses meticulously. Use a spreadsheet or budgeting app to record every dollar that comes in and goes out. This detailed tracking will provide you with a comprehensive understanding of your financial situation and enable you to make informed decisions about your spending.

Step 1⁚ Track Your Income

The first step in creating a Dave Ramsey zero-based budget is to track your income. This involves identifying all sources of income, including your salary, wages, bonuses, and any other regular or irregular income streams. Be sure to account for all income, including side hustles, investments, and even gifts. Once you have a comprehensive list of your income sources, calculate your total monthly income. This figure will serve as the foundation for your budget, as it represents the total amount of money you have available to spend, save, and invest.

Step 2⁚ List All Expenses

Next, you need to create a comprehensive list of all your expenses. This involves analyzing your spending habits over the past month or two, meticulously documenting every dollar spent. Categorize your expenses into essential needs, such as housing, utilities, food, and transportation, and discretionary spending, such as entertainment, dining out, and subscriptions; Be thorough and honest about your spending habits, including those seemingly small, recurring expenses that can add up over time. This detailed list of expenses is crucial to understanding where your money is going and identifying areas where you can potentially reduce spending.

Step 3⁚ Allocate Every Dollar

Now comes the crucial part⁚ allocating every dollar of your income to a specific purpose. This involves assigning each dollar to a category, whether it’s for essential expenses, debt repayment, savings goals, or even fun money. You’re essentially creating a detailed spending plan, ensuring that every dollar is accounted for. This step requires careful consideration and prioritization. Start with essential expenses, such as housing, utilities, and food, ensuring they are covered. Then, allocate funds for debt repayment, focusing on the highest interest rates first. Set aside money for savings goals, both short-term and long-term. Finally, allocate a small amount for discretionary spending, allowing for some flexibility and enjoyment. The key is to ensure that every dollar is allocated, leaving no room for unplanned spending or financial surprises.

Step 4⁚ Review and Adjust

A zero-based budget isn’t a set-it-and-forget-it system. It requires ongoing monitoring and adjustments. Life is dynamic, and your financial situation can change. Review your budget regularly, at least once a month. Track your actual spending and compare it to your allocated amounts. Identify any discrepancies and adjust your budget accordingly. Perhaps your grocery expenses are higher than planned, or you’ve found unexpected savings in another area. Be flexible and make necessary adjustments to ensure your budget aligns with your current financial reality. Remember, a zero-based budget is a living document, not a rigid rule. It’s a tool to help you manage your money effectively, and it should evolve with your needs and circumstances.

Dave Ramsey Zero-Based Budget Resources

Dave Ramsey offers a variety of resources to help you implement his zero-based budgeting method. These resources are designed to make the process easier and more accessible, whether you prefer a digital or physical approach. Take advantage of these tools to streamline your budgeting journey. You can access a free zero-based budget spreadsheet to track your income and expenses manually. Alternatively, utilize the EveryDollar app, a user-friendly digital platform that allows you to create and manage your budget on the go. For a more in-depth understanding of Ramsey’s financial philosophy, consider reading his book, “Total Money Makeover.” This comprehensive guide provides valuable insights into his approach to budgeting, debt management, and achieving financial freedom.

Free Zero-Based Budget Spreadsheet

If you prefer a hands-on approach to budgeting, Dave Ramsey offers a free zero-based budget spreadsheet that you can download and use. This spreadsheet provides a structured format for tracking your income, expenses, and allocating every dollar. You can categorize your spending, set financial goals, and monitor your progress towards achieving them; This spreadsheet is a great option for individuals who want a simple, offline method for creating and managing their budget.

EveryDollar App

For those who prefer a digital budgeting experience, Dave Ramsey offers the EveryDollar app; This app allows you to create and manage your zero-based budget on your smartphone or tablet. You can track your income and expenses, allocate every dollar to a specific category, and set financial goals. The app also provides helpful features like spending reports and budget alerts, making it easier to stay on track with your financial plan. EveryDollar is a great option for individuals who are tech-savvy and prefer to manage their budget on the go.

Dave Ramsey’s “Total Money Makeover”

For a more in-depth understanding of Dave Ramsey’s zero-based budgeting philosophy and his overall approach to personal finance, consider reading his book, “Total Money Makeover.” This book outlines Ramsey’s seven baby steps to financial freedom, which include getting out of debt, building an emergency fund, and investing for the future. “Total Money Makeover” provides practical advice and real-life stories that can help you gain the knowledge and motivation to achieve your financial goals. The book also includes helpful tools and resources, such as budgeting worksheets and debt snowball trackers, to help you implement Ramsey’s methods.

FAQs

Many people have questions about Dave Ramsey’s zero-based budgeting method. Here are some of the most common inquiries⁚

- What are the 5 steps in creating a zero-based budget? Dave Ramsey’s zero-based budgeting method involves five steps⁚ track your income, list all expenses, allocate every dollar, review and adjust, and repeat the process each month.

- What is the Dave Ramsey Budget Rule? The Dave Ramsey Budget Rule is based on the principle of allocating every dollar of your income to a specific purpose, ensuring that your income minus your expenses equals zero. This eliminates the possibility of overspending and helps you stay on track with your financial goals.

- What is the 0-Based Budget Rule? The 0-Based Budget Rule is synonymous with Dave Ramsey’s budgeting method. It emphasizes that every dollar of your income should be accounted for, whether it’s for expenses, debt payments, or savings goals. This approach ensures that you’re not leaving any money unaccounted for and helps you manage your finances effectively.

What are the 5 Steps in Creating a Zero-Based Budget?

Dave Ramsey’s zero-based budgeting method is a structured approach that helps you gain control of your finances. It involves five key steps⁚

- Track Your Income⁚ Start by listing all sources of income, including your salary, side hustles, and any other regular income streams. This step provides a clear picture of your financial resources.

- List All Expenses⁚ Carefully categorize all your expenses, from fixed costs like rent and utilities to variable expenses like groceries and entertainment. This detailed breakdown helps you understand where your money is going.

- Allocate Every Dollar⁚ The core of zero-based budgeting is assigning every dollar of your income to a specific purpose. This includes expenses, debt payments, savings goals, and even fun money.

- Review and Adjust⁚ Once you’ve created your initial zero-based budget, review it regularly and make adjustments as needed. Life changes, and your financial priorities might evolve.

- Repeat⁚ The key to success with zero-based budgeting is consistency. Repeat the process each month to ensure your budget reflects your current financial situation and goals.

What is the Dave Ramsey Budget Rule?

Dave Ramsey’s budgeting philosophy emphasizes a simple, yet effective rule⁚ “Income minus expenses equals zero.” This means that every dollar of your income should be allocated to a specific expense, debt payment, or savings goal. No money is left unaccounted for. The zero-based budgeting rule encourages intentional spending and helps you avoid overspending or impulsive purchases.

Ramsey’s budgeting method goes beyond simply tracking your income and expenses. It encourages you to prioritize your financial goals and create a plan to achieve them. This could include paying off debt, building an emergency fund, saving for retirement, or investing in your future. By allocating every dollar, you gain a sense of control over your finances and make progress towards your financial goals.

The Dave Ramsey Budget Rule emphasizes the importance of living within your means and avoiding unnecessary debt. It encourages financial discipline and a proactive approach to managing your money.

What is the 0-Based Budget Rule?

The 0-based budget rule is a fundamental principle of Dave Ramsey’s budgeting philosophy. It’s not about having zero dollars in your bank account, but rather about ensuring that every dollar of your income is allocated to a specific purpose. This means you start with a clean slate each month and allocate every dollar you earn to expenses, debt payments, and savings goals, leaving nothing left over.

The 0-based budget rule emphasizes intentionality in spending and helps you avoid overspending or impulsive purchases. It forces you to prioritize your financial goals and make conscious decisions about how you spend your money. By allocating every dollar, you gain a sense of control over your finances and make progress towards your financial goals.

The 0-based budget rule is a powerful tool for achieving financial freedom. It helps you to live within your means, avoid unnecessary debt, and build a solid financial foundation for the future.